Checking the Status of Payments

Disbursement Voucher Payments

- Go to the KFS Accounting Doc Search

- Click Disbursement Vouchers

- Enter the document number in the Document Id field and click search

- Results will appear below the form

- In the results, click on the Document Id number that you entered

- Scroll down to the Pre-Disbursement Processor tab

- Click show to display information in the tab

- The tab will display the Disbursement Information button, click on it

- Look in the Payment Status column to see status

- If the status is open, disbursement has not yet been made

- If the status is extracted, the disbursement number will be displayed, and it has been disbursed

Travel Reimbursement Payments (pre-Concur)

- Go to the Travel Reimbursement System

- Enter the trip number from your trip statement

- Click on the Disbursement Voucher link

- Click on Pre-disbursement Processor tab

- Search the document number in Source Document field

Other Payments

- Go to the KFS Main Menu

- Select Pre-Disbursement

- Under Pre-Disbursement Processor Actvities, click Search for Payment

- Enter the information (that is known) in the appropriate fields to track down status by following the same steps under the Disbursement Voucher section above

Top

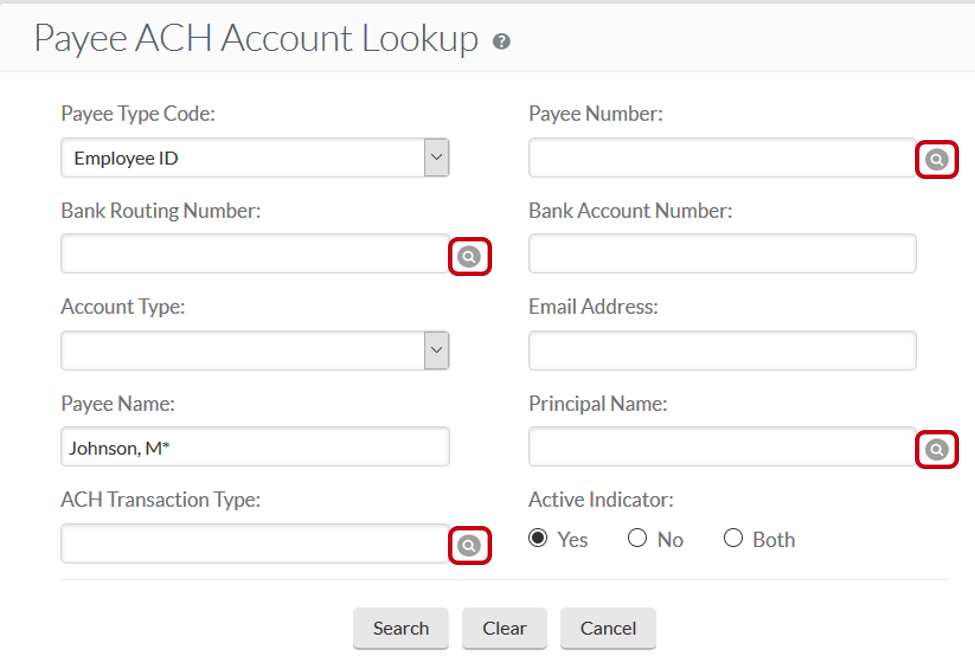

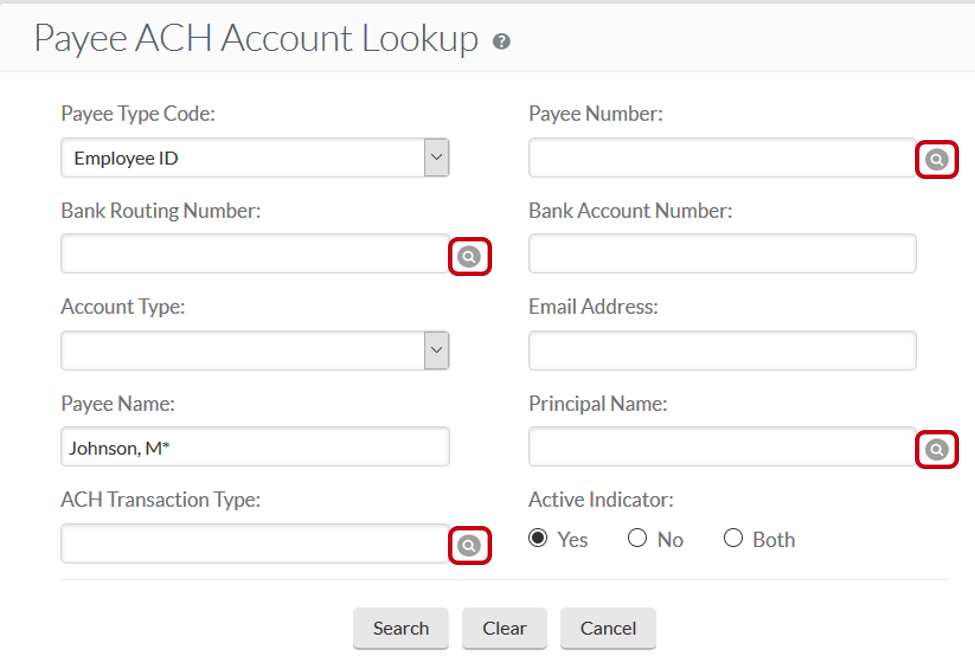

Determining if a Payee Has Enrolled in Direct Deposit (ACH)

The BSC role has permission to view and use the ACH Account Lookup.

- Go to the KFS Main Menu.

- Select Pre-Disbursement.

- Under Pre-Disbursement Administration, select Payee ACH Account.

- For accurate search results, select the appropriate Payee Type Code from drop-down list or enter the NetID in the Principal Name field.

- Click search, and the results should return the account, if it exists.

Top

Bug in Payee ACH Account Lookup

The Payee ACH Account Lookup has a bug that prevents an ACH account from being found if you use the magnifying glass icon from Payee Lookup. Do not use any of the magnifying glasses on the Payee ACH Account Lookup.

Top

Returning Checks to Accounts Payable

If a check is no longer needed, return the original physical check to Accounts Payable, including the reason why the void is needed. As backup, we recommend including a copy of the email requesting a void, which should include the reason for the void. See also, Voided Checks.

Top

Returning Checks to Cornell for Special Handling/Pick-Up

Delivering Checks to DFA for Pick-Up

If a check payment needs special handling (for example, you have paperwork that you need to include with a check payment), you can have checks delivered to Cornell for pick-up.

Follow the instructions below to have FedEx deliver checks to the DFA Front Desk at East Hill Plaza (341 Pine Tree Road). A notification will be sent to the BSC when checks arrive. See the AP Payment Schedule for information on when checks will be available.

- Mark the Disbursement Voucher (DV) for both "Check Enclosure" and "Special Handling."

- When the check is received in DFA, we will contact the appropriate BSC for pick-up. If a check is not picked up within 48 hours, we will attempt to re-contact.

- The individual picking up the check must present a valid Cornell ID card (faculty, staff, student).

- Note: A check does not have to be picked up by the DV preparer named in the "Special Handling" section of the e-doc, but if the individual picking up the check fails to bring a valid Cornell ID card, we will call the DV preparer.

- The individual picking up the check must complete a check pick-up log with the following information:

- Name (printed)

- Signature

- Date

- Email address

Delivering Checks to the Department

Payments not marked with "Check Enclosure" will not be sent to DFA for pickup. You may choose to have checks sent to you directly using "Special Handling" only.

Warning: It's preferred that you use the method above to pick up checks in DFA. If you choose Special Handling only, checks are sent by postal mail (not FedEx) to the address you indicate, which might be a slower process and result in you not receiving the payment in a timely manner.

If choosing Special Handling only:

- Include a completed mailing address:

- Name: Cornell University Department/Unit Name

- Address 1: DV Preparer Name

- Address 2: Cornell Building or Street Address

- City: Ithaca

- State: NY

- Zip: 14853 + 4-digit extension (including the 4-digit extension seems to speed up the return mail process)

Top